GGV Capital VCs Announce New Brands After Splitting U.S. and Asia Operation. Jenny Lee and Jixun Foo, longtime leaders at GGV Capital, have revealed the new branding for their separate ventures following the division of the firm’s U.S. and Asia teams.

Going Separate Ways

The Singapore-based operation, now known as Granite Asia, is headed by Jenny Lee and Jixun Foo, both native Singaporeans. Jenny Lee, a prominent figure on Forbes’s Midas List, boasts nine IPOs in the past five years, including Xiaomi and Kingsoft WPS. Jixun Foo, previously the global managing director of GGV Capital, is credited with notable deals such as Xpeng Motors, Didi, and Grab. Granite Asia will focus on startups in China, Japan, South Asia, Australia, and Southeast Asia.

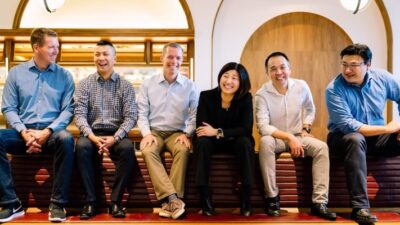

On the other side of the split, the U.S.-based team has rebranded as Notable Capital. Led by veteran investors based in Menlo Park, including Hans Tung, Jeff Richards, and Glenn Solomon, Notable Capital plans to continue investing in the U.S., Europe, and Latin America. Hans Tung’s portfolio includes Airbnb, StockX, and Slack, while Jeff Richards has backed Coinbase, Tile, and Handshake. Glenn Solomon’s deals include HashiCorp, Opendoor, and Drata. Oren Yunger, a recent addition to GGV Capital, remains part of the Notable team. Eric Xu, based in Shanghai, will continue overseeing the original firm’s yuan-denominated funds.

Team GGV

The Reason for Split

The decision to rebrand came as both teams began operating separately, with each team opting to develop new brands. This move echoes a similar split at Sequoia Capital last year, which saw its U.S. team retaining the Sequoia brand while its Asia operations were rebranded.

GGV Capital had previously raised $2.5 billion for its new funds, its largest family of funds at the time. Following the split, Granite Asia now manages a collective $5 billion, while Notable Capital oversees approximately $4.2 billion, based on GGV Capital’s assets under management at the time of the split announcement.